A Tier 1 Competitor’s Shocking H1 Results: How China’s Joyson Electronics Grew Profits 11% Amidst a Global Price War

A Tier 1 Competitor’s Shocking H1 Results: How China’s Joyson Electronics Grew Profits 11% Amidst a Global Price War

The global automotive industry is caught in a perfect storm. OEMs are waging a brutal price war, the transition to electrification is squeezing margins, and supply chain instability remains a constant threat. For most Tier 1 suppliers in Europe and the US, this has meant a period of intense pressure and conservative forecasts.

That’s why the H1 2025 financial report from one of our key Chinese competitors, Ningbo Joyson Electronics Corp., landed like a shockwave. While many are struggling to stay afloat, Joyson didn’t just survive; it thrived.

This isn’t just a story about one company’s success. From my vantage point here in Shanghai, it’s a clear blueprint for a new survival formula in the Tier 1 space—one that incumbent suppliers in Europe and the US must understand to compete.

The Numbers That Defy the Market

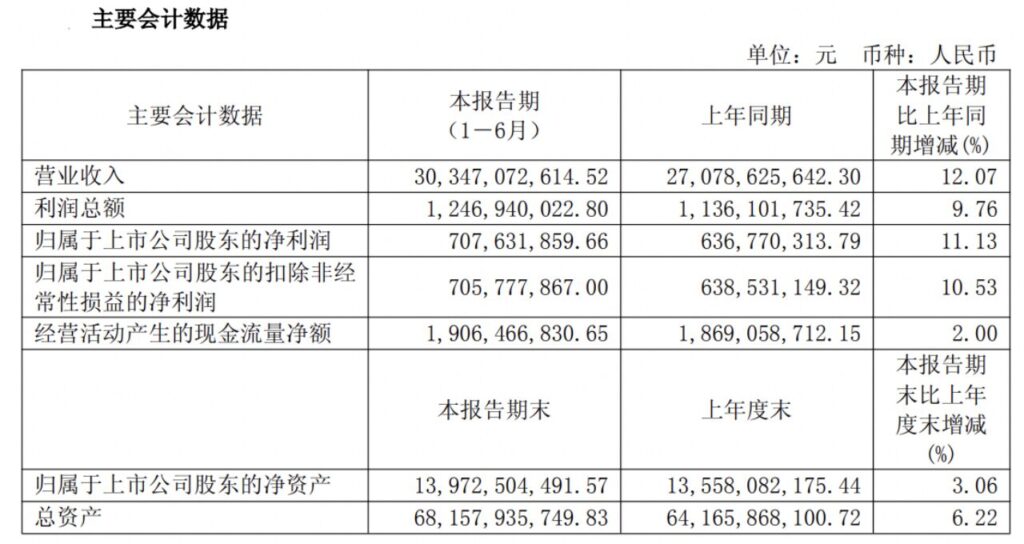

<center>Joyson Electronics H1 2025 Financial Summary</center>

On August 25, Joyson Electronics released its H1 2025 results, which paint a picture starkly different from the rest of the industry.

- Revenue: ¥30.35 billion (approx. $4.2B), a 12.07% increase year-over-year.

- Net Profit: ¥708 million (approx. $97.5M), an 11.13% increase year-over-year.

- Overall Gross Margin: Rose by 2.6 percentage points to 18.2%.

In a market where many are sacrificing profitability for volume, Joyson has managed to increase both. The critical question for us is: how?

The Three Pillars of Joyson’s Counter-Cyclical Success

Joyson’s strategy is a masterclass in turning crisis into opportunity. Their success can be broken down into three core pillars.

1. Aggressive Global Cost Optimization

The single biggest driver of Joyson’s increased profitability is a relentless and strategic approach to cost reduction on a global scale. This isn’t about simple belt-tightening; it’s a fundamental re-engineering of their global operations.

- Global Sourcing Shift: They are systematically replacing higher-cost components from traditional suppliers in their overseas plants with more cost-effective alternatives from their Chinese supply chain.

- Production Relocation: They are actively moving production capacity from high-cost regions to lower-cost countries, such as expanding an airbag factory in the Philippines to leverage Southeast Asia’s cost advantages.

The results are undeniable. The gross margin for their overseas operations jumped by 3.0 percentage points to 17.8%, demonstrating the power of this ‘glocalization’ strategy.

2. A Decisive Pivot to High-Growth Sectors

Joyson isn’t just saving money; they are reinvesting it with precision into the future of mobility. With an R&D investment of ¥2.49 billion (approx. $343M) in the first half of the year alone, they have firmly aligned their portfolio with the EV and smart vehicle megatrends.

This is reflected in their new business wins:

- Total New Orders: ¥31.2 billion (approx. $4.3B) in life-cycle orders were secured in H1.

- NEV Dominance: Over 66% of these new orders are for new energy vehicle (NEV) platforms, locking in future growth.

They are winning major projects for next-generation E/E architectures, including high-level ADAS domain controllers in partnership with firms like Momenta. This proves they are not just a hardware supplier anymore but a key player in the software-defined vehicle (SDV) ecosystem.

3. Diversification Beyond the Car

Perhaps the most forward-thinking move is their strategic expansion beyond the automotive sector. Earlier this year, Joyson officially announced its entry into the humanoid robotics industry, leveraging its core competencies in electronic control units, sensing technology, and high-volume manufacturing.

They have already established a new subsidiary and are developing key components like controllers and power management modules for leading robotics companies. This creates a “second growth curve” that de-risks their business from the volatility of the automotive market.

The New Playbook for Global Tier 1 Suppliers

Joyson Electronics’ performance isn’t a Chinese anomaly; it’s a strategic playbook that every global supplier needs to study. The formula is clear:

- Master Glocalization: Use a global footprint not just for market access, but as a flexible tool to constantly optimize cost structures across different regions.

- Invest Ahead of the Curve: Shift R&D resources aggressively towards high-growth areas like SDV, ADAS, and electrification to capture the next wave of high-margin business.

- Think Horizontally: Identify core technological strengths and apply them to adjacent high-growth industries to build resilience and new revenue streams.

The era of relying on long-standing relationships and incremental improvements is over. As Joyson’s results show, the Tier 1 suppliers who will win the future are those who combine global operational agility with a relentless focus on the technologies that will define the next generation of mobility—and beyond.

Deeper Dive: Recommended Reading for Deeper Insights

For those who wish to explore the strategic principles behind today’s topic, I personally vet and recommend the following books.

[The Machine That Changed the World (James P. Wack, Daniel T. Jones, Daniel Roos)]

- Why it’s relevant: This seminal book details the lean production system that revolutionized the automotive industry. Understanding these principles is crucial for grasping how a Tier 1 supplier like Joyson Electronics is optimizing its global operations to compete in the modern era of electrification and intense cost pressure.

- 👉 [Insert Amazon Affiliate Link]

This post may contain affiliate links from Amazon Associates, meaning I may earn a commission if you make a purchase.

My AI Jazz Project: