BYD’s Shocking H1 Earnings: Why a $2.1B Profit Hides a Desperate Gamble

Just a few months ago, the narrative surrounding BYD was one of impending doom. Headlines focused on a mountain of debt, razor-thin margins from a brutal price war, and whispers of a crisis. It seemed the world’s largest EV maker was a giant on shaky ground.

Then, on August 29, BYD released its first-half 2025 financial results, and in one move, silenced every skeptic.

The numbers weren’t just good; they were a stunning display of financial power that defied the global economic downturn. But the real story isn’t just about the record-breaking profit. It’s about how this success paradoxically creates an even greater pressure, forcing BYD into a high-stakes gamble. And it begs two crucial questions: Why are they chasing an impossible target? And can we even trust these numbers?

The Numbers That Silenced the Skeptics

BYD’s H1 2025 performance was nothing short of a broadside against the competition. While legacy automakers reported headwinds, BYD posted record growth across the board.

BYD H1 2025 Financial Highlights:

- Total Revenue: 371.3 billion yuan (approx. $51.9B), a 23.3% increase year-over-year.

- Net Profit: 15.5 billion yuan (approx. $2.1B), a 14% increase YoY.

- Automotive Revenue: 302.5 billion yuan (approx. $42.3B), a staggering 32.5% increase YoY.

- R&D Investment: 30.9 billion yuan (approx. $4.3B), a 53% increase YoY and more than double their net profit.

- Overseas Sales (Jan-Jul): Over 550,000 units, a 130%+ increase YoY, already surpassing the full-year total for 2024.

These figures paint a clear picture. The company that many thought was teetering under debt was, in fact, generating enormous profits and reinvesting them at an astonishing rate into future technology.

The Real Story: The Impossible 5.5 Million Unit Target

Despite this flawless report card, the pressure inside BYD’s Shenzhen headquarters is likely at an all-time high. The reason is the colossal annual sales target they set for 2025: 5.5 million vehicles.

Let’s do the math:

- Jan-Jul Cumulative Sales: 2.49 million units.

- Units Needed in Remaining 5 Months (Aug-Dec): 3.01 million units.

- Required Monthly Average: Approximately 602,000 units.

This required run rate is astronomical. It’s more than 220,000 units higher than their best-ever sales month. While H2 sales are typically stronger than H1, bridging this gap seems nearly impossible. Some analysts are already predicting they will miss the target, forecasting a finish closer to 5.0-5.3 million. Even hitting 5.1 million would mean falling short by 400,000 units.

But Wait, Can’t They Just Revise the Target?

This is the crucial question. For most companies, missing a forecast is disappointing but manageable. For BYD in the current Chinese market, the sales target is more than just a number; it’s a strategic weapon. Backing down is not a simple option.

- The Flywheel of Scale: BYD’s entire business model is built on massive scale to drive down costs. The 5.5 million target was a promise to accelerate this flywheel, achieve unprecedented cost reductions, and financially suffocate competitors in the price war. Missing the target slows the flywheel, weakening their core competitive advantage.

- Supply Chain Dominance: An aggressive target gives BYD immense leverage over its suppliers. The promise of massive, future orders allows them to demand lower prices and better payment terms. If that promise is broken, their negotiating power erodes.

- Investor Confidence: As a publicly traded company, the sales target is a commitment to the market. A significant miss signals a slowdown, spooking investors and potentially impacting their stock price and ability to raise capital.

- Psychological Warfare: In the brutal battlefield of China’s auto market, momentum is everything. The 5.5 million goal was a declaration of dominance intended to demoralize rivals. Failing to meet it would be seen as a sign of weakness, emboldening the competition.

A Reader’s Question: Can We Really Trust BYD’s Financials?

This is a valid and persistent question surrounding Chinese corporations. The memory of accounting scandals at other firms has created a healthy dose of skepticism. However, in the case of a global giant like BYD, outright fabrication is highly unlikely for a few key reasons.

- The Hong Kong Listing: This is the most critical factor. BYD is dual-listed in both Shenzhen and Hong Kong. The Hong Kong Stock Exchange (HKEX) operates under much stricter international regulatory standards and requires audits by global firms. The legal and financial consequences of fraud on this stage would be catastrophic.

- Global Scrutiny: BYD is not operating in a vacuum. It is intensely scrutinized by global investors, competitors, and analysts. Its numbers can be cross-verified against data from its international suppliers (like chipmakers), shipping partners, and vehicle registration data from the dozens of countries it now operates in.

- Focus on the Trend: While one can debate the nuances of specific accounting entries, the overall trend is undeniable. Explosive revenue growth, massive R&D spending, and rapidly growing global market share are verifiable facts. The direction and velocity of the company are clear, even if there’s some fog around the precise numbers.

Conclusion: The Real Threat to Global Competitors

The H1 2025 results prove that the real threat from BYD isn’t a fragile giant collapsing under debt. The real threat is a highly profitable, cash-rich juggernaut that is reinvesting at a pace no legacy automaker can match, all while pushing itself to meet impossibly ambitious goals.

Their relentless overseas expansion is no longer just about selling cheap cars; it’s a technology-driven offensive backed by massive R&D and a vertically integrated supply chain. For Tesla, Volkswagen, Ford, and others, the competitor is not a wounded animal. It is a well-fed predator that is still hunting as if it’s starving. That is a far more dangerous proposition.

Shokz OpenRun Pro 2 vs. Sanag B60S Pro (2025): Premium Sound or 64GB Freedom?

Tired of earbuds that block out the world and feel cumbersome during a workout? You’re not alone. Bone conduction headphones are the perfect solution, delivering great audio for music and calls while leaving your ears open for situational awareness.

The undisputed king of this market is Shokz. But a powerful new challenger, the Sanag B60S Pro, has emerged in 2025, packed with features that are impossible to ignore. I’ve looked at both. Here’s the ultimate guide to help you decide.

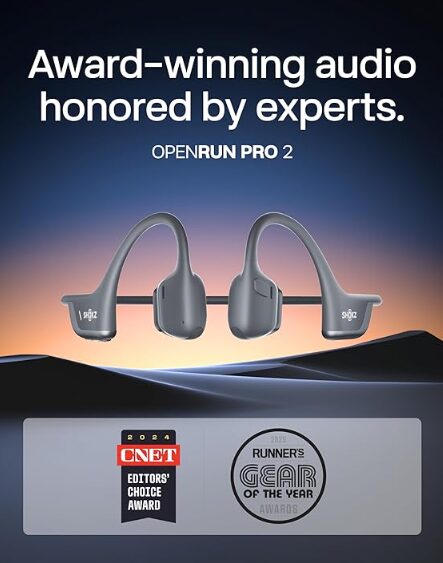

The Reigning Champion: Shokz OpenRun Pro 2

If you demand the absolute best in open-ear audio, the Shokz OpenRun Pro 2 is your answer. The build quality is exceptional, the fit is feather-light and secure for any activity, and the sound is astonishingly clear.

Thanks to its enhanced bass transducers and dual noise-canceling microphones, music is rich and calls are crystal clear, making it a reliable performer for both workouts and work calls. It’s the polished, premium experience that has earned Shokz its stellar reputation.

- Pros: Exceptional sound quality, superior comfort and build, and a trusted brand name.

- Cons: Premium price tag.

Verdict: The Shokz OpenRun Pro 2 is for the person who wants a no-compromise audio experience combined with total awareness.

👉 Check Price on Amazon: Shokz OpenRun Pro 2

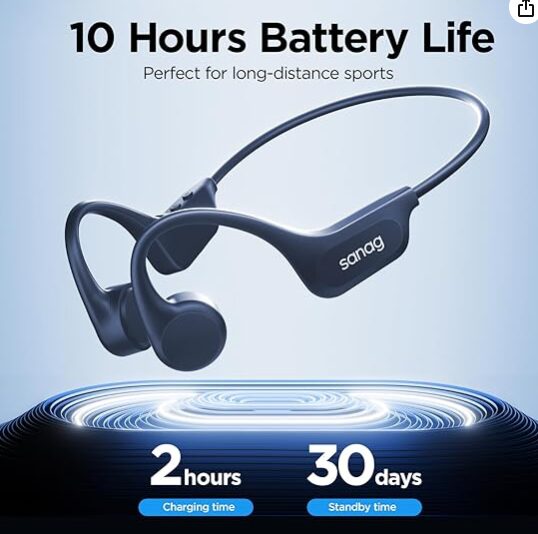

The Feature-Packed Challenger: Sanag B60S Pro (2025 Model)

The new Sanag B60S Pro is engineered for those who want more features for less money. Its spec sheet is seriously impressive.

First, it comes with a whopping

64GB of built-in MP3 storage. That means you can load it with thousands of songs and leave your phone at home—perfect for distraction-free runs. Second, it boasts a true

IPX8 waterproof rating, making it fully submersible up to 2 meters. While this is great for swimmers, for the rest of us, it means it’s completely immune to sweat and heavy rain.

With

10 hours of battery life , CVC noise reduction for calls , and advanced tech to reduce sound leakage, the Sanag B60S Pro makes a compelling case for the best value on the market.

- Pros: Incredible value, IPX8 waterproof rating , massive 64GB MP3 storage , solid 10-hour battery life.

- Cons: Audio fidelity doesn’t quite match the premium Shokz.

Verdict: The Sanag B60S Pro is perfect for the athlete who wants durable, phone-free freedom or anyone seeking the best bang-for-your-buck in the bone conduction space.

👉 Check Price on Amazon: Sanag B60S Pro

My Final Recommendation: Who Should Buy Which?

This decision comes down to one question: are you chasing perfection or incredible value?

| Feature | Shokz OpenRun Pro 2 | Sanag B60S Pro | |

| Best For | Audiophiles, All-Day Wear, Call Quality | Value Seekers, Swimmers, Phone-Free Listeners | |

| Sound Quality | Excellent: Premium and balanced | Good: Solid for workouts and daily use | |

| Key Feature | Superior Audio & Comfort | IPX8 Waterproof & 64GB Storage | |

| Battery Life | 12 Hours | 10 Hours | |

| Price Point | Premium $$$ | Budget-Friendly$$ |

- Choose the Shokz OpenRun Pro 2 if: Your budget allows, and you demand the best possible sound, comfort, and call quality from an open-ear headphone.

- Choose the Sanag B60S Pro if: You want incredible features for the price. The freedom of phone-free listening with 64GB of storage and the durability of a true waterproof design make it a fantastic value proposition.

Both are excellent choices, but they are built for different users. Decide what matters most to you, and you’ll have a winner.

As an Amazon Associate, I earn from qualifying purchases. Sources