BYD Overseas Factories: The Shocking Secret Behind Its Pivot from Hungary to Turkey

A surprising shift is underway in the global expansion strategy of electric vehicle giant, BYD. The plans for its BYD overseas factories, particularly those targeting the European market, are being drastically revised, drawing significant attention to the underlying motives. The original plan to establish Hungary as a core production hub in the heart of the EU is being scaled back, while momentum shifts decisively towards Turkey.

This is more than a simple adjustment of production timelines; it signals a fundamental change in the equation BYD uses to conquer the global market. From my perspective as a market analyst based in China, this article provides an objective, in-depth analysis of this strategic shift and the real reasons hidden beneath the surface.

BYD on the Global Chessboard: Facing Two Immense Pressures

To understand BYD’s decision, we must first examine the macroeconomic environment it operates in.

- The EU’s Tariff Wall: The European Union recently announced additional tariffs on Chinese-made EVs. For BYD, this means facing a composite tariff rate of 27.1% (10% base + 17.1% new tariff). This poses a critical threat to its price competitiveness, creating an urgent need to circumvent these duties through local production within or near Europe.

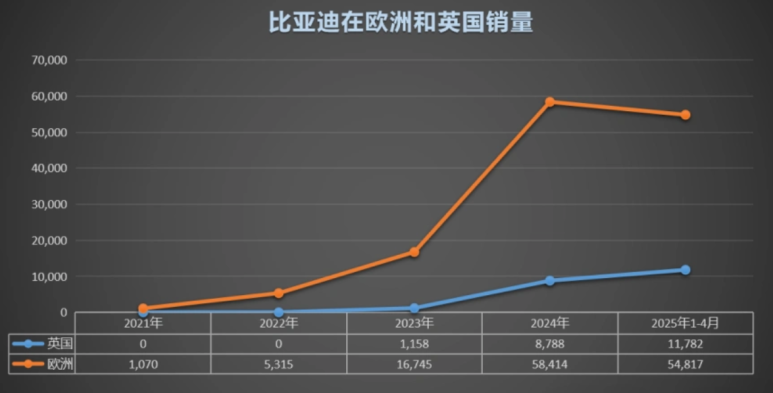

- China’s Domestic “Price War”: Simultaneously, the Chinese domestic market is embroiled in a cutthroat price war. Eroding profitability is forcing companies to look abroad for growth, making a “going global” strategy, or ‘Chuhai’ (出海), essential for survival. BYD’s ambitious target of 800,000 overseas sales in 2025 is a direct result of this pressure.

These two forces have presented BYD with a challenging mandate: “Produce locally in Europe, but do it as cheaply as possible.”

The Core Strategic Shift: Hungary ‘Slowdown’ vs. Turkey ‘Acceleration’

Against this backdrop, BYD’s strategy for its BYD overseas factories has been dramatically altered:

- Hungary Factory (Production Scaled Down): The plant under construction in Szeged, Hungary, was initially planned to produce 150,000 vehicles annually starting in 2026. Under the revised plan, the first-year output in 2026 will be reduced to just tens of thousands of units, with this lower production rate expected to continue for two years, through 2027.

- Turkey Factory (Production Accelerated): In stark contrast, the plant in Manisa, Turkey, is on the fast track. Originally slated to begin production of 150,000 units per year by the end of 2026, the timeline has been moved up for an earlier launch in 2026, with output expected to significantly exceed the original targets. Production will surpass 150,000 in 2027, with further increases planned for 2028.

This is a major strategic pivot, effectively shifting the primary base camp for its European market assault from Hungary to Turkey.

Beyond “Tariff Evasion”: The Rise of “Cost-First” Strategy

So, why did BYD choose Turkey over EU member state Hungary? The answer lies beyond the surface-level reason of tariff avoidance. The most decisive factor is cost.

According to industry analysis, labor costs in Turkey are approximately 35-40% lower than in Hungary. Crucially, while Turkey is not an EU member, it is part of the EU Customs Union. This means manufactured goods produced in Turkey can be exported to the EU tariff-free.

BYD’s calculation is clear: if it can enjoy the same “0% tariff” benefit, choosing the location with significantly lower production costs is the most logical move. This is a considerable blow to the EU, which had hoped its tariff policy would attract Chinese investment and create manufacturing jobs within the bloc. Instead, BYD has skillfully found a loophole to achieve a more cost-effective outcome.

(For more details, refer to the official report from [Gasgoo Automotive News – a high-authority external link]).

BYD’s New Global Triangle: Connecting Europe, South America, and Asia

This strategic adjustment extends beyond Europe, clarifying BYD’s global production footprint.

- South American Hub (Brazil): The plant in Bahia, Brazil, is set to become the first passenger car production base outside of Asia, with operations targeted to start in July 2025. It plans to expand from an initial capacity of 150,000 units to 300,000, serving the entire South American market.

- Southeast Asian Hub (Thailand, etc.): The factories in Thailand (150,000 units/year) and Uzbekistan (300,000 units/year) are operating stably, catering to the Southeast and Central Asian markets.

This reshuffle reveals BYD’s new global “triangular formation”: ‘Turkey (for Europe) – Brazil (for South America) – Southeast Asia.’ By establishing key production hubs on each continent, BYD aims to optimize logistics, neutralize tariff barriers, and implement its “cost-first” strategy worldwide.

Future Outlook: Plans are Not Promises, Variables Remain

The revision of the BYD overseas factories strategy showcases the company’s remarkable agility in responding to a changing market. It is a calculated move to secure both tariff avoidance and cost reduction.

However, it is too early to assume a smooth path forward. Unforeseen variables such as political risks in Turkey, future changes in its relationship with the EU, and local labor issues could emerge at any time.

What is certain is that BYD is evolving from being just a high-volume car seller into a sophisticated “global chess player” that considers geopolitical risks and supply chain dynamics in its master plan. Its next move will be crucial in shaping the landscape of the global automotive market.

My AI Jazz Project: