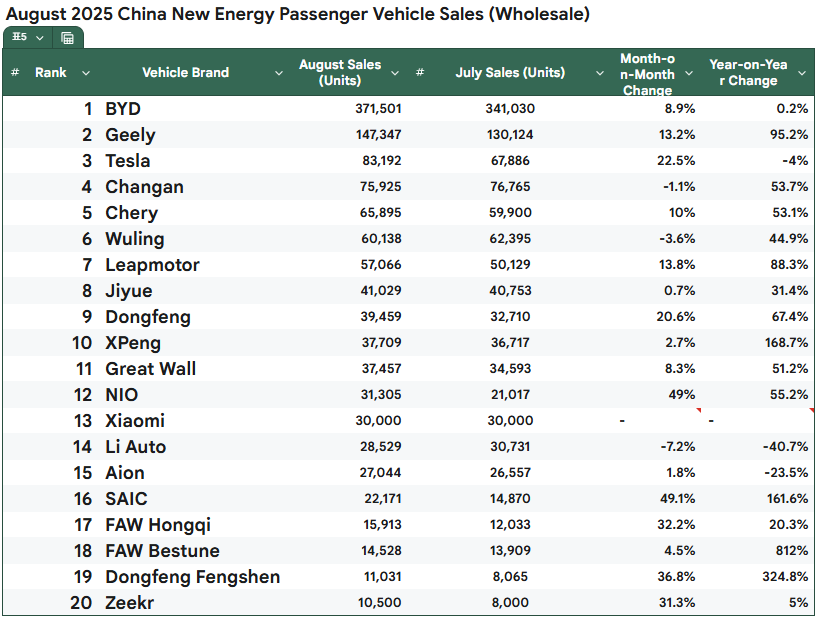

China EV Sales Shock: BYD Growth Flatlines at 0.2% YoY, Geely Surges 95% as Market Faces Brutal Reshuffle

On the surface, China’s New Energy Vehicle (NEV) market looked robust in August 2025, posting 1.3 million wholesale units for a healthy 24% year-over-year (YoY) gain. But beneath this headline number, a brutal market reorganization is underway, signaling the end of the hyper-growth era for some and a violent consolidation of power for others.

The August sales data is a story of stark contrasts: the invincible giant has stalled, the challenger is sprinting, and established players (including Tesla) are falling behind. This isn’t just growth; it’s a brutal sorting of who has the right strategy for China’s saturated market.

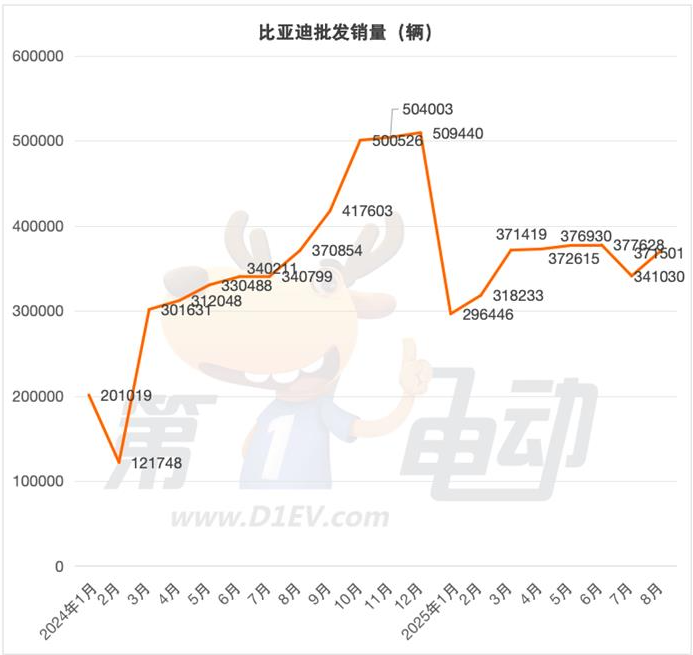

The Giant’s Crisis: BYD’s 0.2% Growth Shock

BYD remained the undisputed king, selling 371,501 units. The shock, however, is in the growth rate. While up 8.9% month-over-month, its YoY growth was a staggering 0.2%. For an empire built on triple-digit expansion, this is a functional stall.

This slowdown has critical implications. By the end of August, BYD had achieved only 51.5% of its ambitious 5.5 million unit annual target. Consequently, local media reports (citing sources like First Electric Net) now claim BYD is considering a 16% cut to its annual target (down to 4.6 million). This would mark BYD’s slowest year of growth in the last five years, signaling a definitive end to its era of market insurgency.

While its new Seal and Sea Lion models are performing well (over 100k units combined), core volume models like the Song PLUS saw sales collapse, revealing portfolio fatigue and internal cannibalization.

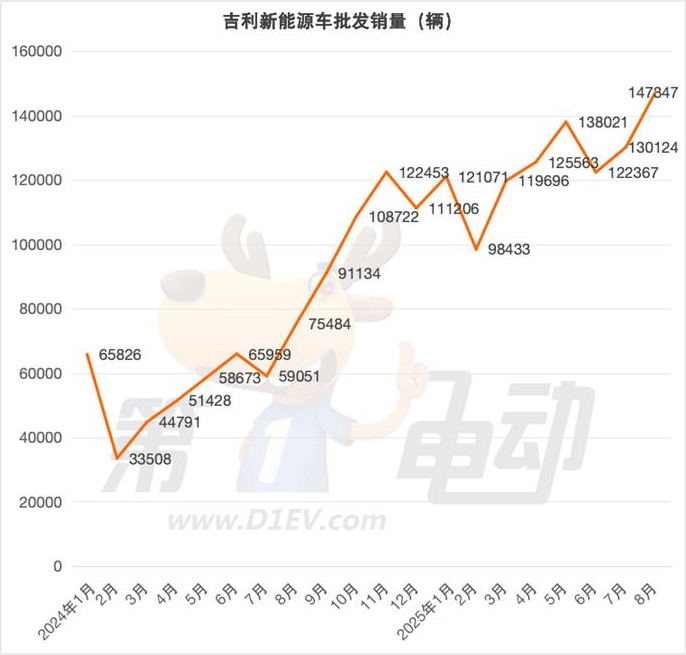

The Challenger’s Sprint: Geely’s 95% Surge

As BYD stumbled, Geely Auto sprinted. The company locked in the #2 spot with a record 147,300 units, representing a massive 95% YoY surge.

Geely’s success is a masterclass in portfolio strategy:

- Mainstream Dominance (Galaxy): The new Galaxy brand is the core driver, selling 110,700 units (+173% YoY). It successfully covers all price points, from the mass-market Star Wish (48k units) to the successful mid-range E5 and Starship 7 (both 10k+/mo), plus red-hot pre-sales for the new A7 and M9.

- Premium Success (Zeekr & Lynk & Co): Geely proved it can win at the high end. Zeekr delivered 17,600 units, and its ultra-luxury 9X SUV secured 42,600 orders in one hour. Lynk & Co also grew a solid 21%.

Unlike BYD’s (previously) monolithic approach, Geely’s multi-brand strategy is proving more resilient, capturing consumers fleeing other brands across every single market segment.

The Establishment Tumbles: Tesla, Li Auto, and Aion All Slide YoY

The pain wasn’t confined to BYD’s slowdown. Other established power players saw sharp YoY declines.

- Tesla: Sold 83,192 units. While a strong 22.5% recovery from July, it still marks a 4.0% YoY decline. Tesla is facing immense pressure from local competitors. (However, strong rumored orders for the new Model Y L variant may fuel a September rebound).

- Li Auto (Lixiang): Was the month’s biggest loser. At 28,529 units, it suffered a devastating 40.7% YoY drop (and a 7.2% MoM drop). The brand is banking on the new i6 model and an organizational reset to stop the bleeding.

- Aion: Dropped 23.5% YoY. Aion’s problem is strategic: its entire portfolio is trapped in the hyper-competitive, bloody mid-market, fighting BYD, Geely, and Changan without the premium brand cachet of Nio or Xpeng.

The Dark Horses: A Survival Blueprint for Legacy JVs (Nissan)

Two “dark horses” revealed an alternative path to survival. FAW Bestune surged 812.0% by smartly avoiding the main fight, targeting Tier 3 & 4 “sinking markets” with affordable entry-level EVs.

But the most important story for global automakers comes from Dongfeng-Nissan, which surged 324.8% (11,031 units). Its success, driven by the Nissan N7 (over 10k units), proves that a legacy Joint Venture (JV) can succeed in China’s NEV market by effectively leveraging its established brand trust and dealer network into a hit electric model. This provides a vital, tangible blueprint for survival for every other struggling JV, including VW, GM, Ford, and Hyundai.

Conclusion: The End of “Easy Growth”

The August data is definitive: the “grow-at-all-costs” phase of China’s EV market is over. The market is saturated, and survival now demands strategic perfection—either through precise portfolio management (Geely), niche targeting (Bestune), or leveraging legacy strengths (Nissan). BYD remains the giant, but its crisis will force a reaction, likely accelerating the price war as it fights to meet even its revised targets.

My AI Jazz Project: