The Real ‘Auto Evergrande’: The Cautionary Tale of the Billion-Dollar Ghost Car You’ve Never Seen

The Real ‘Auto Evergrande’: The Cautionary Tale of the Billion-Dollar Ghost Car You’ve Never Seen

When people discuss the Chinese EV bubble, they often point to struggling startups like NIO and ask, “Could they be the next Evergrande?” It’s an interesting question, but it misses the punchline: we don’t need to look for the “next” one. The real “Evergrande of the Auto Industry” already exists, and its story is even more dramatic.

That’s right, the infamous property group Evergrande has its own car company: Evergrande Auto. Their EV brand is called ‘Hengchi’. Never heard of it? You’re not alone. Seeing a Hengchi on the street is said to be harder than plucking a star from the sky. It’s a true automotive unicorn.

Today, we’re diving into the shocking current state of this legendary ghost company, based on their latest, desperate announcements.

The Final Countdown: A Delisting Ultimatum

On the night of August 7th, Evergrande Auto released a statement that sent a chill through the market. They had received a final warning from the Hong Kong Stock Exchange.

- Trading Halted: The company’s stock has been suspended since April 1, 2025, and will remain so.

- The Deadline: They have until September 30, 2026, to meet all conditions for trading to resume. If they fail, they could be permanently delisted and wiped off the market.

This isn’t just a company in trouble; it’s a company on life support, and the exchange is ready to pull the plug.

The Wall of Reality: Big Money, No Cars (at Scale)

How did it come to this? Their start was as grand as anyone’s. In 2019, Evergrande stormed the EV scene with a massive war chest. They acquired Sweden’s NEVS (the successor to Saab) and invested in supercar maker Koenigsegg, attempting to buy their way to the top.

But my previous blog post title, “They spent the money, but the cars didn’t come out,” though a bit of an exaggeration, captured the essence of their failure. To be precise, some cars did come out. Their first model, the Hengchi 5, actually entered production, and just over 1,000 units were delivered to actual customers.

But compared to the tens of billions of dollars invested and the promise of mass production, it was a catastrophic failure. The factory land they acquired in Guangzhou was eventually repossessed by the government for being idle. The search for new investors in early 2025 failed, leading directly to the trading suspension.

Conclusion: A Lesson Written in Billions

The story of Evergrande Auto is a textbook case of what happens when ambition and capital are not matched by industrial discipline and execution. They focused on acquiring assets rather than mastering the brutally complex art of building and selling cars at scale.

While other Chinese EV makers are fighting a bloody price war to survive and grow, Evergrande Auto is fighting a much more fundamental battle: simply trying not to vanish. Their tale serves as the ultimate cautionary tale from the EV gold rush—a stark reminder that in the auto industry, talk is cheap, and building cars is incredibly hard.

Deeper Dive: Recommended Reading for Deeper Insights

The story of Evergrande Auto is a textbook case showing that a grand vision and investment funds alone cannot guarantee success. For a deeper look into how a hyped-up company can mislead markets and ultimately collapse, I recommend this book.

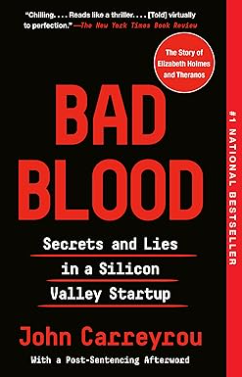

[Bad Blood: Secrets and Lies in a Silicon Valley Startup]

- Why I recommend it: This book covers the ‘Theranos’ scandal that shook Silicon Valley, vividly showing how overhyped technology and a leader’s ambition can deceive investors and the market, ultimately leading to ruin. It will provide deep insight into understanding the structural problems behind Evergrande Auto’s fall.

- 👉 Read Book here

This post contains affiliate links. As an Amazon Associate, I may earn from qualifying purchases.

My AI Jazz Project: