Beyond Tech: Why Global Auto Suppliers Bet on China for ‘Trust,’ Not Just Tech

Global auto suppliers are pouring money into China, but it’s not just about technology anymore. Discover why the real strategic play is about leveraging the Chinese market to build global ‘trust’—a factor Chinese rivals can’t easily replicate.

The Investment Paradox: Why Bet on China Amidst Decoupling?

Despite the pervasive rhetoric of decoupling, foreign auto suppliers in China are doubling down. In 2025, giants like Bosch, ZF, and Valeo are expanding R&D and production across the country. This isn’t just about capturing the local market anymore. It’s a strategic pivot to an “In China, For Global” model, using the world’s most competitive market as a launchpad for the rest of the world. But with the technology gap all but closed, what is the real endgame?

The Data: A Surge of Foreign Investment in 2025

The facts on the ground speak for themselves. Here is a snapshot of major new investments and expansions by foreign Tier 1 suppliers in China from January to July 2025.

| Company | Project/Content | Date | Location | Key Investment Highlight/Goal |

| Autoliv | Groundbreaking of Wuhan Tech R&D Center | Jul 27 | Wuhan, Hubei | Over 20,000 m² area, covering R&D offices, advanced labs, and core functions. |

| Hella | Groundbreaking of Phase 2 Plant Project | Jul 22 | Changshu, Jiangsu | New 37,300 m² plant for R&D and manufacturing of new energy thermal management & hydrogen components. |

| Nexteer | Groundbreaking of Smart Manufacturing Plant | Jul 15 | Liuzhou, Guangxi | Over 40,000 m² to produce Column-assist Electric Power Steering (CEPS) systems and controllers. |

| Forvia | Joint Venture agreement with Huadu Semiconductor | Jun 30 | Guangzhou, Guangdong | Integrating funds, technology, and channel resources to co-develop new technologies. |

| Gates | Unveiling of Wuhan Innovation Center | Jun 26 | Wuhan, Hubei | Forms a “dual-engine” with Shanghai R&D to drive innovation in zero-emission tech. |

| ZF | Opening of Aftermarket Remanufacturing Center | Jun 24 | Lingang, Shanghai | Expanding the remanufactured product portfolio and investing in new product R&D. |

| Valeo | Groundbreaking of Smart Cockpit R&D/Production Base | Jun 24 | Guangzhou, Guangdong | Innovating smart cockpit products (HUD, smart displays) and intelligent manufacturing. |

| ZF LIFETEC | Investment in airbag & gas generator expansion | Jun 15 | Xi’an, Shaanxi | To better serve the local market and improve supply efficiency and quality. |

| Continental | Groundbreaking of Automotive APAC HQ Project | Apr 22 | Jiading, Shanghai | Establishing the APAC automotive headquarters and significantly expanding R&D investment. |

| Forvia Hella | Launch of new Asia Aftermarket Laboratory | Apr 8 | Shanghai | Comprehensively enhancing testing capabilities in the thermal management field. |

| Magneti Marelli | Upgrade of China R&D Center to APAC Innovation Hub | Mar 31 | Shanghai | Integrating APAC R&D resources to strengthen local technological advantages. |

| Aptiv | NEV Battery Connection System Project Agreement | Mar 21 | Jiading, Shanghai | Providing high-efficiency, safe high-voltage distribution solutions for major OEMs. |

| Valeo | Opening of CDA Guangzhou Smart Interaction R&D Center | Mar 14 | Guangzhou, Guangdong | Developing and applying advanced HMI technology in the smart cockpit domain. |

| ZF | Establishment of advanced manufacturing JV in Guangzhou | Mar | Guangzhou, Guangdong | R&D and production of passive safety electronics like airbag controllers and sensors. |

| Schaeffler | Completion of China Technology Center Expansion | Feb 18 | Chongqing | Adding new labs to enhance engineering design, testing, and product development capabilities. |

| Valeo | Opening of Valeo NEV Lighting (Changzhou) Co., Ltd. | Jan 16 | Changzhou, Jiangsu | Producing diversified products including smart cockpit ambient lighting and HMI systems. |

| Nexteer | Opening of New Base | Jan 15 | Changzhou, Jiangsu | Expanding global advanced steering system manufacturing and testing capabilities. |

| Schaeffler | Establishment of Schaeffler Hydrogen Tech (Shanghai) Co. | Jan 6 | Jiading, Shanghai | Focusing on R&D and production of hydrogen-related technologies and solutions. |

The End of the ‘Tech Advantage’ Myth

Let’s be blunt: the era of sustained Western technological superiority in automotive software is over. Chinese firms, powered by a massive IT talent pool and a hyper-competitive domestic market, have achieved parity—and in some areas of user experience (UX) and in-car OS, even surpassed—global competitors. The idea that a “core technology” can be safely guarded in a home country headquarters is an outdated fantasy. So, if it’s not about a defensible tech advantage, what is the fight really about?

The New Battlefield: Shifting from Technology to Trust

The competitive axis is shifting from ‘who has the better tech’ to ‘who is more trusted’. This is where established global players have a defensible moat that new Chinese challengers will struggle to cross, especially outside their home market.

The Trust Asset: Safety and Data Privacy

For decades, global brands have navigated and met the world’s most rigorous safety standards, from Euro NCAP to the US IIHS. This builds a legacy of trust in the fundamental safety and reliability of their products. Furthermore, in an era of intense scrutiny over data privacy (e.g., GDPR in Europe), being a ‘trusted’ non-Chinese entity with a proven track record of protecting user data is a powerful and increasingly valuable differentiator.

The Global Experience Asset: Beyond a Single Market

There’s a deep, institutional knowledge that comes from serving the nuanced needs of a truck driver in Texas, a city dweller in Paris, and a family in Southeast Asia. This ability to understand and cater to diverse global cultures and use cases is an asset built over decades. It’s a breadth of market understanding that domestic-focused Chinese companies, despite their scale, currently lack.

The New Playbook: From Tech Gatekeeper to Trust Orchestrator

The winning strategy for foreign auto suppliers in China is no longer about hoarding “core technology” at home. It’s about becoming a ‘global trust orchestrator’.

This new model involves:

- Using China as a high-speed, high-pressure testbed to rapidly innovate and refine technology for a demanding consumer base.

- Using Europe and North America as centers for developing core platforms that meet the highest global standards for safety, security, and data privacy.

- Using the corporate HQ as the ‘global control tower’ that integrates these efforts, ensuring that the final product, sold anywhere in the world, is synonymous with the brand’s core promise of ‘trust’.

Conclusion: Winning the War for Global Trust

In a world of increasingly commoditized technology, the ultimate competitive advantage isn’t found in a single feature or patent. It lies in a brand’s ability to earn and maintain trust on a global scale. While Chinese companies will undoubtedly dominate their domestic market, the war for the global consumer’s trust is a different battle entirely—one that will be won through a proven legacy of safety, security, and a deep understanding of the world beyond one’s own borders.

Deeper Dive: Recommended Book for Deeper Understanding

For those who wish to delve deeper into the strategic dynamics discussed today, here is a book I personally recommend.

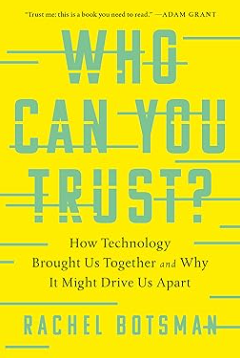

[Who Can You Trust?: How Technology Brought Us Together and Why It Might Drive Us Apart by Rachel Botsman]

Recommendation Reason: As technology becomes commoditized, the new competitive frontier is trust. This book masterfully explains how trust is shifting from institutions to networks and platforms. It provides the perfect lens to understand why a global brand’s legacy of safety and data integrity—assets Chinese rivals can’t easily replicate on a global scale—has become the most critical competitive advantage in the automotive industry today.

👉 Link to Buy Book

As an Amazon Associate, I earn from qualifying purchases.