Geely’s Profit Crisis: Why Volvo’s Owner Is Selling Record Cars But Losing Money – The Shocking Truth

On paper, Geely Auto, the Chinese automotive giant that owns Volvo, Polestar, and Lotus, just had the best six months in its history. In the first half of 2025, the group reported a stunning 47% surge in sales to 1.41 million vehicles and a record-breaking revenue of 150.2 billion yuan (approx. $20.7 billion).

By all accounts, this should be a moment of triumph. Yet, the market’s reaction was a shrug. Geely Auto’s stock price actually fell by 1.81% after the announcement, and more alarmingly, profits attributable to shareholders plummeted by 14%.

How can a company sell more cars than ever before yet see its profits shrink? This isn’t just a financial anomaly. It’s a stark signal of a deep-seated crisis within China’s second-largest automaker, revealed by none other than its own CEO in a moment of shocking candor. What he admitted reveals the critical challenges facing not just Geely, but the entire Chinese auto industry as it pushes onto the global stage.

The CEO’s Startling Confession: Three Critical Failures

While the numbers told a story of explosive growth, Geely Auto’s Executive Director, Gui Shengyue, painted a much darker picture during the earnings call. He openly discussed three fundamental “shortcomings” that are holding the company back.

1. Failure in Brand Building: “Our Customers Felt Betrayed”

The first admission was a stunning critique of the company’s own brand strategy. “Although we have been building cars for over 30 years… we still have many shortcomings in brand building,” Gui stated.

But the most critical part of his confession was this:

“In the era of intelligence, if users are completely unaware of our product’s future development plans, we are effectively depriving them of their right to know and choose. This makes users feel betrayed.”

This is a direct acknowledgment of the backlash Geely faced over its ZEEKR brand, which underwent frequent and rapid model updates, alienating early adopters who saw their brand-new cars become “old models” in a matter of months. As we analyzed in our previous post, [The Fall of ZEEKR 001: A Casualty of the Xiaomi Shock and Internal Cannibalization], this pursuit of short-term sales has severely damaged long-term customer trust. Gui’s apology signals a recognition that volume alone cannot build a premium brand.

2. The Export Collapse: “Our Biggest Shortcoming”

The second confession was, in many ways, more alarming for its global competitors. While Geely was breaking records at home, its international efforts were failing.

- H1 2025 Exports: 184,100 units (an 8% decrease year-over-year)

- Export Share of Total Sales: 13%

Gui Shengyue did not mince words, calling the export performance “our biggest shortcoming (最大短板)” and admitting it “lags behind competitors” and is “unworthy” of the company’s domestic status. A 30-40% sales plunge in a single Eastern European market was cited as a major cause, exposing the company’s vulnerability to regional risks—a topic we explored in [The Russia Dilemma for Chinese Auto Exports]. While the company has since restructured its overseas operations, it is now playing catch-up in a global race it once seemed poised to dominate.

3. The Profitability Dilemma: Selling More, Earning Less

Finally, the CEO addressed the core paradox of the earnings report: profitability. While sales volume skyrocketed, the quality of those sales deteriorated.

- Average Selling Price (ASP): 96,000 yuan (a 14,000 yuan decrease YoY)

- Gross Profit Margin: 16.4% (a 0.3 percentage point decrease YoY)

The reason is simple: the sales mix has shifted. Growth from high-margin premium brands like ZEEKR and Lynk & Co has slowed, while the bulk of the new sales came from the lower-priced, mass-market “Galaxy” series.

This is a classic case of prioritizing volume over value. Geely is successfully selling more cars, but it’s making less money on each one. This trend raises a dangerous question: Has Geely’s ambitious push into the premium segment, a strategy built on the technology and reputation of its European assets like Volvo, stalled?

Conclusion: Beyond the Numbers, a Battle for Identity

Geely’s H1 2025 results are a cautionary tale. Explosive sales figures can mask fundamental weaknesses in brand trust, global strategy, and profitability. The company is now at a critical juncture.

While it continues to invest heavily in the future—spending 7.3 billion yuan (approx. $1 billion) on R&D in the first half and strengthening its powertrain joint venture with Renault—it must first fix its foundation. The success of upcoming flagship models like the Lynk & Co 900 and ZEEKR 9X will be a crucial test. Can they reignite high-margin growth and prove that Geely is more than just a mass-market champion?

Ultimately, the CEO’s shocking honesty reveals that the battle for the future of the auto industry is shifting. The era of growth at any cost is ending. Now, the winners will be those who can balance volume with value, speed with trust, and domestic dominance with true global competitiveness.

Deeper Dive: Recommended Reading for Deeper Insight

For those who wish to gain a more profound understanding of the topics discussed today, here is a professional book I have personally reviewed and recommend.

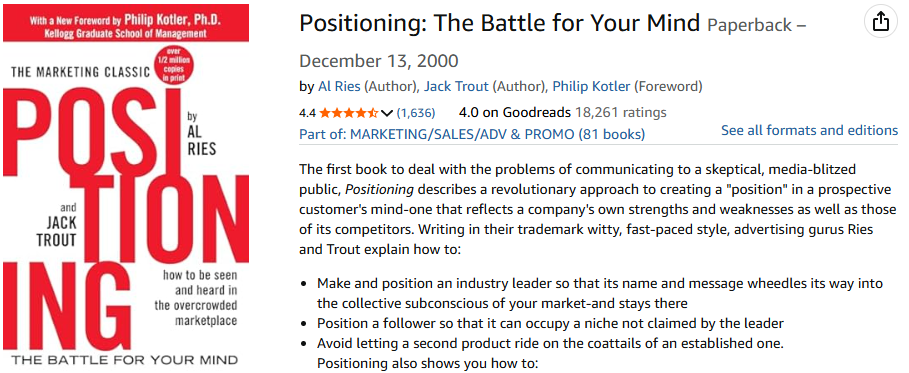

[Positioning: The Battle for Your Mind]

- Recommendation Rationale: It’s no coincidence that Geely’s CEO identified “a lack of brand building” as their primary failure. This classic marketing book provides the fundamental principles for establishing a powerful brand identity in the consumer’s mind, especially within a fiercely competitive market. For Geely, the lessons in this book are crucial if they hope to evolve beyond being a volume seller and become a true premium player on the global stage.

- 👉 Read Book Here

This post may contain affiliate links from Amazon Associates, from which I may earn a commission.

My AI Jazz Project: