Why Global Automakers Can’t Be Starbucks in China’s Brutal EV Market

The Starbucks Paradox: Why Are Automakers Joining a Price War They Should Be Above?

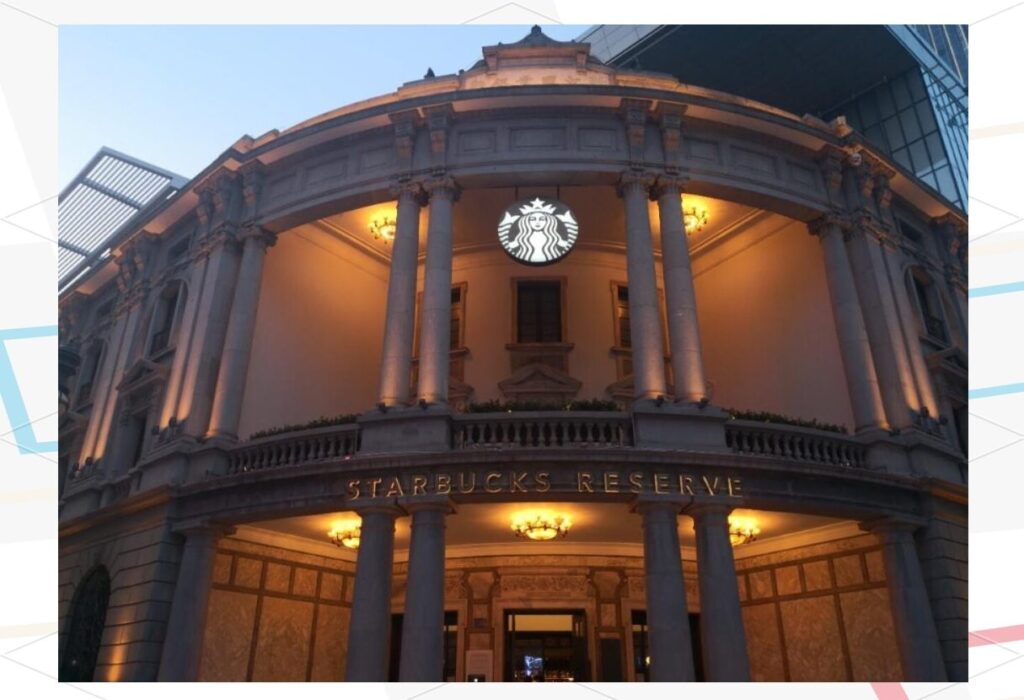

For the last two years, China’s coffee market has been a brutal battlefield. Local brands like Luckin and Cotti have waged a “9.9 RMB coffee” price war, willing to burn cash for market share. Yet, one player has serenely stayed above the fray: Starbucks. They refused to compete on price, and remarkably, their business thrived.

Now, shift this scene to the auto industry, and something is deeply wrong. The global automotive OEMs—the companies that should be the “Starbucks” of their industry—are inexplicably jumping into the trenches to fight that 9.9 RMB war.

This isn’t just about discounts. These giants, who once sold a powerful brand identity built on “100 years of heritage” and “German engineering,” are now lowering prices, accepting technology from Chinese partners, and slowly erasing their own identity. Using the Starbucks strategy as a lens, let’s analyze this perilous tightrope walk.

1. The Starbucks Playbook: Selling an Emotion, Not Just Coffee

Starbucks’ genius lies not in its coffee, but in its masterful psychology. It sells an “emotional value” and an “experience.” From its unique “Tall-Grande-Venti” sizing that makes a small feel like a medium, to the minimal price gaps that nudge you to upgrade, every detail is designed to make the customer feel smart and satisfied. The brand is a powerful moat that insulates them from price wars.

2. The Giants’ Dilemma: Abandoning the Playbook

Legacy automakers once had this moat. Values like “German engineering reliability,” “unparalleled safety,” and “the joy of driving” were their “Starbucks experience.” But facing a tidal wave of competition in China, they are now surrendering this precious asset.

- Entering the Price War: Brands like Volkswagen and Toyota are slashing prices on their core models, competing directly with local players like BYD on their terms. This is an admission that they are willing to trade their premium status for volume.

- Diluting Identity: More critically, they are accepting “technology transfusions.” When Volkswagen uses Xpeng’s platform or another OEM uses Huawei’s software, the lines blur. Is the customer buying German technology or Chinese innovation? The “Starbucks coffee” is now being mixed with generic syrups, confusing the customer and diluting the brand.

3. The Real Reason They Can’t Be Starbucks: A Forced Innovation

But was there ever a choice? Perhaps not. The fundamental reason global OEMs can’t remain “Starbucks” is that their core product was disrupted against their will.

Starbucks’ tradition is a weapon because its core technology—brewing coffee—is stable. In contrast, the auto industry’s shift from the internal combustion engine (ICE) to the electric vehicle (EV) is a complete “technological rupture.”

An OEM’s entire heritage was built on ICE technology: the visceral sound of a V8 engine, the mechanical feedback of a precision transmission, decades of engine-tuning know-how. In the EV era, this legacy instantly becomes a museum piece. It’s no longer a marketable asset.

Having lost their primary weapon, the giants are forced to fight on a new battlefield with rules defined by their rivals: battery efficiency, charging speed, and software integration. On this new turf, they are not champions; they are challengers.

Conclusion: An Inevitable Surrender

Viewed from this angle, the OEMs’ current strategy is not a failure of will but an inevitable act of survival. They cannot win on their tradition, and they are behind on future technology. All that’s left is to compete on price and accept help from local tech leaders to stay in the game.

In the end, they were forced to step down from the comfortable throne of “tradition” and jump into the muddy fight for “survival.” It’s not that they couldn’t be Starbucks; it’s that the era where they could remain Starbucks is over.

My AI Jazz Project: