Mercedes’ China Collapse: Is a 50% Price Crash the Canary in the Coal Mine for its Global Empire?

A shocking development is unfolding in the world’s largest auto market. Mercedes-Benz, the century-old titan of luxury, is in a state of freefall in China. The A-Class is being sold at a staggering 50% discount , and the brand’s Q2 global net profit has cratered by a jaw-dropping 68.7%.

From a European or American perspective, it’s tempting to dismiss this as a distant, regional problem. But this is a dangerously shortsighted view. What happens in China rarely stays in China. The crisis Mercedes is facing is not just about sales figures; it’s a symptom of a fundamental failure to adapt to a new era, a potential “Nokia moment” that could have severe repercussions for its entire global empire.

The Anatomy of a Meltdown

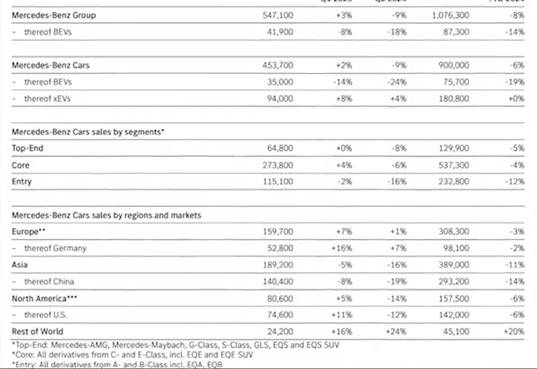

The numbers paint a grim picture of the situation for Mercedes-Benz. A 19% sales decline in its single largest market is a disaster , leading to waves of dealership bankruptcies across major Chinese cities. This isn’t a gentle downturn; it’s a collapse.

But the “why” is far more critical. This isn’t happening because Chinese consumers have suddenly lost their appetite for luxury. It’s happening because the very definition of “luxury” has been rewritten by a new generation of tech-savvy competitors.

While Mercedes continues to charge annual subscription fees for basic functions like navigation and remote start—features local brands offer for free for life—companies like AITO, backed by tech giant Huawei, are offering a seamlessly integrated “smartphone on wheels” experience. The fight is no longer about the quality of the leather trim; it’s about the intelligence of the software. Mercedes brought a classic timepiece to a smartwatch fight, and it’s losing badly.

The Evaporation of Brand Premium

For decades, the three-pointed star stood for the pinnacle of automotive engineering and prestige. That brand value was its strongest shield. But in China, that shield has been shattered.

The most influential, tech-forward buyers—the new elite—are abandoning Mercedes in droves for domestic smart EVs like the AITO M9 and Li Auto L9. These consumers don’t see Mercedes as the ultimate status symbol anymore; they see it as lagging technology. As one analyst aptly put it, “when your target audience starts to think scrolling on a short-video app is more impressive than driving your car, the brand is in serious trouble.” This exodus of trendsetters causes the brand premium to evaporate and transfer to the new tech leaders.

The Ripple Effect: A Warning for Europe and the US

This is not just a Chinese problem. The collapse in China, which has long been a critical cash cow, severely weakens Mercedes’ ability to fund the massive R&D investments needed to compete globally in the EV and autonomous age.

Furthermore, the Chinese competitors, now battle-hardened and armed with cutting-edge technology validated in the world’s most competitive market, are beginning their export push into Europe. The very weaknesses Mercedes has shown in China—slow software development, a clunky user experience, and a rigid business model—will be mercilessly exploited on its home turf.

The crisis forces Mercedes into an impossible dilemma: does it stick to its meticulous, slow-paced development process that guarantees quality but falls behind on innovation? Or does it adopt a faster, riskier software-first approach that could dilute the “safety and reliability” ethos at the core of its brand?

What we are witnessing is a historic paradigm shift. The crisis in China is a brutal preview of the battle all legacy automakers will face. The question is no longer if this disruption will spread globally, but when. And whether Mercedes-Benz can learn from its “Nokia moment” in China before it’s too late.

Deeper Dive: Recommended Books for Further Study

For those who wish to gain deeper insights into the topics discussed today, here are some expert books I have personally reviewed and recommend.

- [The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail]

- Recommendation Reason: To understand the structural forces causing a market leader like Mercedes-Benz to falter against disruptive Chinese innovators, there is no better guide. This book perfectly explains the paradox of how making ‘correct’ business decisions can lead to failure when the market’s core technology shifts.

This post may contain affiliate links from Amazon Associates, from which I may earn a small commission.

My AI Jazz Project: