SAIC’s Big Bet: Why It Sacrificed a Star Software Brand for Market Dominance

As a marketer working on the ground in China, I witness the relentless pace of its auto industry every day. It’s a market where new models launch weekly and today’s cutting-edge tech becomes tomorrow’s standard feature. In this battlefield, Chinese auto giant SAIC has just made a strategic move that has everyone talking: they’ve merged Z-One (零束), their celebrated software subsidiary, into their central R&D Center.

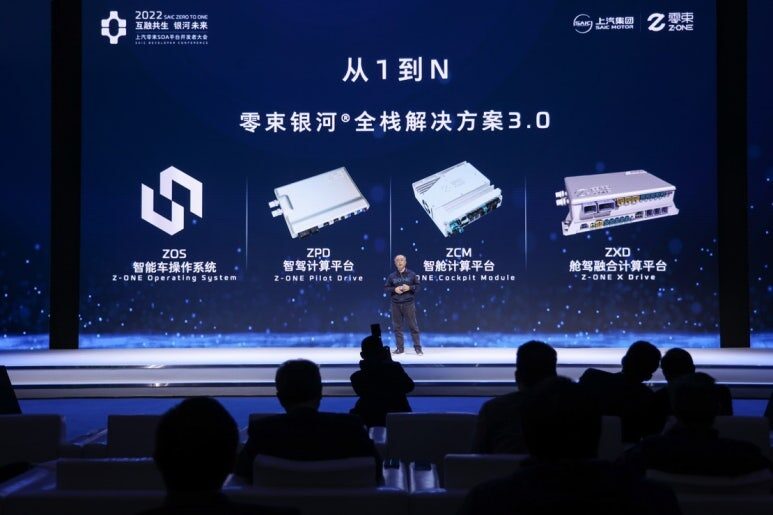

What makes this so fascinating from a marketing perspective is that Z-One wasn’t just an internal team. It was a rising star, a brand in its own right. It recently won massive, high-profile contracts to build the entire software and E/E architecture for a new SAIC-Audi EV and a new SAIC-VW model. Z-One was the cool, innovative sub-brand that proved SAIC could play at a world-class level.

So why fold a winning brand into the corporate mothership? The answer reveals a bold strategy to conquer the market through scale, speed, and a unified brand experience.

The Strategy: From “Separate Teams” to “One Army”

This merger is the heart of SAIC’s new “Big Passenger Car” strategy. For too long, its brands like MG, Roewe, and Feifan operated in silos, competing as much with each other as with rivals. This led to duplicated R&D efforts and slower response times—a critical weakness against agile competitors like BYD who leverage massive scale.

SAIC’s solution is to tear down the walls. By creating a single, unified “Technical Middle Platform” powered by the combined force of its R&D Center and Z-One, they are moving from “separate teams” to “one army.” The new mission is to develop core technology once and deploy it everywhere. It’s a classic play for economies of scale, aimed squarely at winning China’s infamous price wars.

The Marketing Payoff: Standardizing the “Wow” Factor

So, is the Z-One brand dead? Not exactly. It’s more accurate to say its elite DNA is being infused into the entire SAIC organism. This has two powerful implications for marketers:

- Democratizing Premium Tech: The advanced software and architecture that earned the trust of Audi and VW will no longer be exclusive to high-end models. This technology will become the standard across the entire SAIC portfolio. Imagine being able to market ADAS features or a seamless digital cockpit, once reserved for premium JVs, in an affordable MG. That’s a powerful value proposition.

- A Consistent, Modern Brand Experience: By standardizing the tech stack, SAIC can ensure a consistent, high-quality user experience across all its vehicles. This strengthens the master brand and builds consumer trust, making the entire portfolio more competitive.

The Goal is Clear: Win on Speed and Price

SAIC has been transparent about its targets, and they are a marketer’s dream:

- Cut new vehicle development time by 40%.

- Reduce vehicle BOM (Bill of Materials) cost by 30%.

In a market defined by speed and cost, these figures are game-changing. They mean SAIC can react to trends faster and offer more features for the money, or simply undercut competitors on price. This is the ammunition needed to fight and win in China.

Conclusion: A Calculated Risk for a Huge Reward

SAIC is trading the brand equity of a single, cool subsidiary for the chance to elevate its entire fleet. It’s a calculated risk—the agility and innovative culture of Z-One could get lost in the bureaucracy of a larger organization.

However, if they succeed, the reward is immense. SAIC will have transformed from a collection of disparate brands into a unified tech powerhouse, capable of delivering a superior, software-defined experience at an unbeatable price point. As a marketer here, I’ll be watching closely to see how this new strategy translates into their future product launches and advertising campaigns. This bold move has the potential to shake up the entire market.

My AI Jazz Project: