Volkswagen’s Profit Shock: How China Turned from Cash Cow to a Black Hole

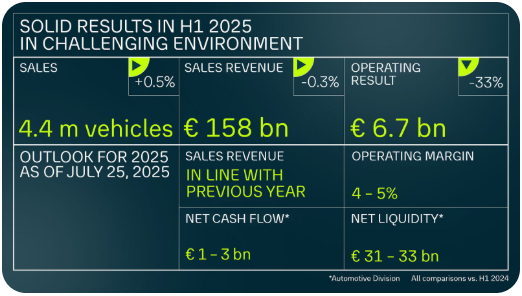

Volkswagen Group’s latest earnings report sent a tremor through the financial markets. Despite a 1.3% increase in vehicle sales in the first half of 2025, operating profit plummeted by a staggering 33%. How can a company sell more cars but make significantly less money?

As a market analyst on the ground in China, I can tell you the answer isn’t found in Wolfsburg. The root cause of this profit crisis lies squarely within Volkswagen’s operations in its largest and most critical market: China.

The Numbers Don’t Lie: A Story of Decoupling Profit

First, the official data released on July 25th paints a stark picture:

- H1 Revenue: €158.4 billion (-0.3% YoY)

- H1 Operating Profit: €6.7 billion (-33% YoY)

- H1 Deliveries: 4.405 million units (+1.3% YoY)

This decoupling of sales volume from profit is the ultimate red flag. It signals that the profitability per vehicle is in a freefall. And the epicenter of this collapse is the Chinese market, which has transformed from Volkswagen’s cash cow into a veritable profit black hole.

The Sobering Reality Behind the Collapse in China

For decades, Volkswagen’s global profits were fueled by high-margin internal combustion engine (ICE) vehicle sales in China. That winning formula is now broken.

- The EV Quagmire: Volkswagen’s joint ventures (with SAIC and FAW) are struggling immensely in the EV space. Despite aggressive discounts, sales are stagnant. There are even local industry rumors that VW loses up to 40,000 RMB (approx. $5,500) on each EV sold. Their dedicated EV venture, VW-Anhui, saw its first model, the Cupra Tavascan, achieve disastrous sales of fewer than 100 units per month.

- The Crumbling ICE Fortress: The real damage comes from the erosion of their traditional stronghold. To defend market share against the onslaught from BYD and other local brands, Volkswagen has been forced to implement massive discounts on its high-volume ICE models like the Passat and Tiguan. The very products that once subsidized their global operations are now part of the problem.

- Global Headwinds Amplify the China Problem: While China is the primary driver, slowing EV demand in Europe adds to the pressure. Strong performance in North America is simply not enough to offset the catastrophic profit collapse in a market as vast as China.

A Bleak Outlook with a Single Point of Hope

This grim reality is reflected in the company’s slashed full-year guidance for 2025. The revenue growth forecast was cut from “up to 5%” to “flat,” and the operating return on sales was lowered significantly.

Inside the industry, it’s clear that Volkswagen is pinning nearly all its hopes on a new EV architecture slated for launch in late 2025. Until then, it faces a painful period of defending its position while bleeding profit.

Conclusion: The Giant’s Dilemma

Volkswagen’s earnings crisis is a cautionary tale for every legacy automaker heavily reliant on the Chinese market. The world’s largest auto market has transformed into its most brutal battleground. The game is no longer about just being present; it’s about surviving a war of attrition where profits are the first casualty.

My AI Jazz Project: