Xiaomi’s “Recall” vs. Tesla’s Updates: Why China’s War on ‘Stealth Recalls’ is a Game-Changer for Global Automakers

When Xiaomi announced a recall of over 116,000 of its new SU7 EVs, headlines could have easily read “Tech Giant Stumbles.” But the real story isn’t about a faulty part. The recall requires no visit to a service center, no physical fix. It’s being handled entirely Over-the-Air (OTA).

This isn’t just a story about Xiaomi’s software bug (A). The truly critical story (B) is that this event marks the end of an era for the entire auto industry: the age of the ‘stealth recall’. China, the world’s largest and most advanced EV market, has drawn a line in the sand, and global automakers from Volkswagen to Ford and Tesla have no choice but to pay attention.

The Global Context: A Regulatory Gray Area No More

Before we dissect Xiaomi’s specific case, we must zoom out to the global context. OTA updates are a cornerstone of the Software-Defined Vehicle (SDV). While incredibly convenient, they have also created a massive regulatory gray area. For years, manufacturers globally have fixed software bugs—some with critical safety implications—under the guise of “performance enhancements” or “feature optimizations.”

This practice of the “stealth recall” conveniently allowed automakers to avoid the negative press and regulatory scrutiny of an official recall, while depriving consumers of their right to know about potential safety defects in their vehicles.

China decided to end this ambiguity. In a move that demonstrated significant foresight, the State Administration for Market Regulation (SAMR) issued a formal notice back in 2020, explicitly stating that OTA updates used to fix design or manufacturing defects are to be managed as official recalls and must be filed with the authorities. This was further strengthened in early 2025 by the Ministry of Industry and Information Technology (MIIT).

Xiaomi’s Recall: A Case Study in the New Compliance

Viewed through this regulatory lens, Xiaomi’s situation looks entirely different.

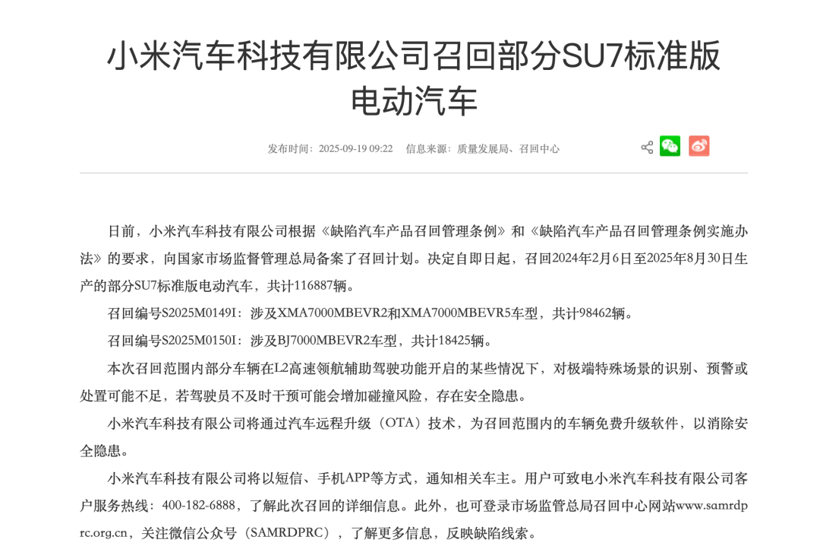

- What’s Being Recalled: 116,887 SU7 Standard models.

- The Defect: The Level 2 highway assist function showed “insufficient” recognition and response capabilities in certain “extreme special scenarios,” posing a potential collision risk.

- The Fix: A remote software patch delivered via OTA.

Notably, the higher-end SU7 Pro and Max models, which use a more powerful dual-chip NVIDIA system and LiDAR, are unaffected. This suggests the issue is tied to the standard model’s less powerful single-chip, vision-only system—a classic case where hardware limitations are being stretched by software.

Instead of hiding this fix in a version update log, Xiaomi followed the new rules to the letter, filing it as a recall. This makes them the first major brand to publicly navigate these strict regulations on such a massive scale. It’s less a sign of failure and more a signal of the market’s maturation.

The Ripple Effect: A New Reality for VW, Ford, Hyundai, and Tesla

This precedent set in China has massive implications for every global automaker.

- The End of Hiding in Plain Sight: In China, the days of fixing a safety flaw and calling it a “stability improvement” are over. Global brands like VW, GM, and Ford, which are heavily invested in the Chinese market, must now adopt this new level of transparency. This increases compliance costs and the reputational risk associated with more frequent “recall” announcements.

- A New Global Benchmark for Transparency: China isn’t just any market; it’s the crucible where the future of the EV is being forged. This decisive regulatory action creates a new global benchmark. How long can Western regulators in the EU and U.S. allow safety-critical software fixes to go unregulated when the world’s largest market has already acted?

- The Tesla Question: This puts a spotlight on Tesla, the pioneer of OTA updates. While Tesla has used OTAs to fix issues that led to official recalls (e.g., NHTSA investigations), its general practice involves frequent, often vaguely described updates. The Chinese model forces a much stricter, government-audited definition of what constitutes a safety fix versus a feature upgrade.

Conclusion: The Future of Car Ownership Is Being Redefined in Beijing

The Xiaomi OTA recall is not a story about a flawed Chinese car. It’s the story of the end of the automotive industry’s “Wild West” era of software development. It signals a shift from a culture of “launch now, patch later” to one of mandated transparency and accountability.

For executives in Stuttgart, Detroit, and Seoul, the key takeaway is this: the rules of the game for Software-Defined Vehicles have fundamentally changed. A new paradigm, where every line of code is subject to the same scrutiny as a physical bolt, has been established. And that paradigm shift began not in Silicon Valley, but in Beijing.